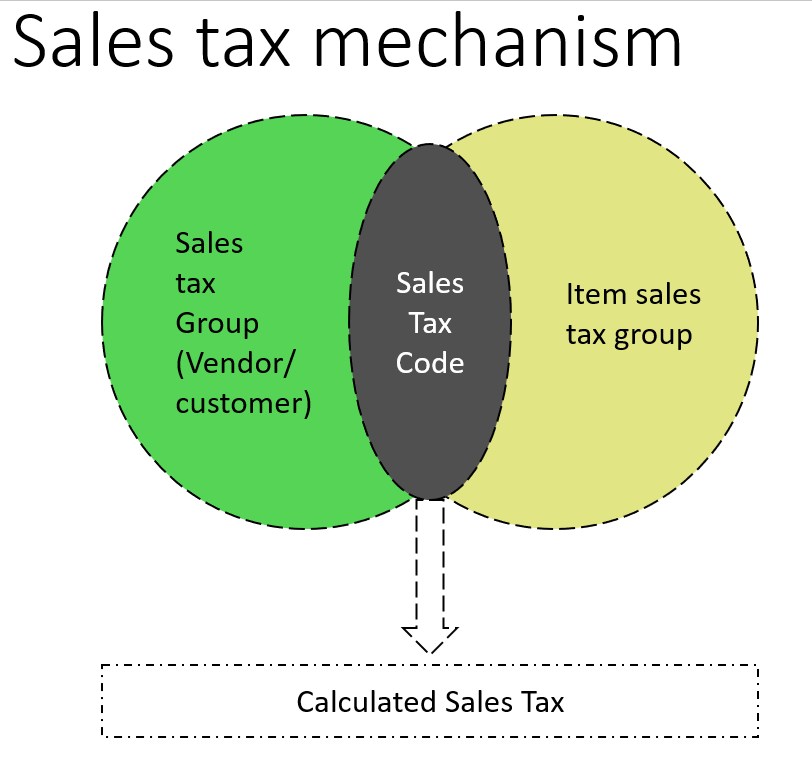

Sales tax is registered on both the vendor/customer level and the item level, to cope with international suppliers that show different tax rates for the same item. The system must recognize the same tax rate in the vendor/customer and item levels to process the transaction. The calculated sales tax on the finance module is shown in the following figure:

In order to create the sales tax code, navigate to Tax | Indirect taxes | Sales tax | Sales tax codes. In the General fast tab, assign the Settlement period and Ledger posting group. In the Calculation fast tab, assign ...