Withholding tax is calculated and executed at the vendor payment process. The calculated reflection of the withholding tax on the finance module will be as follows:

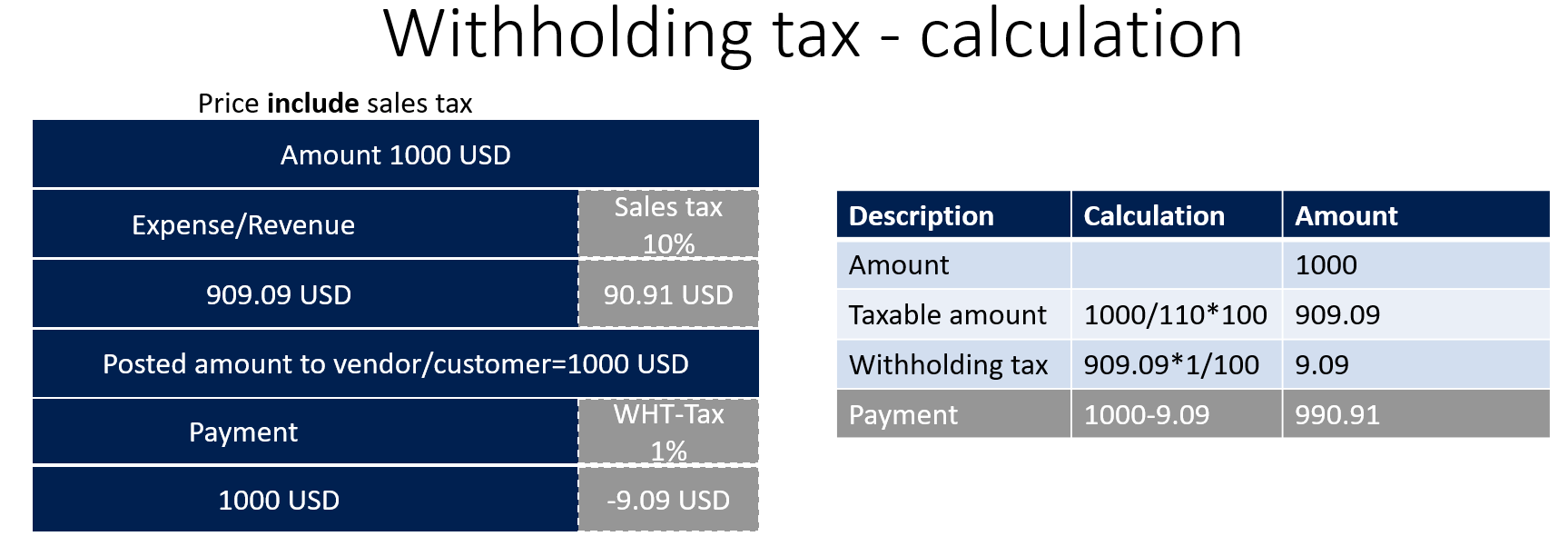

- Price includes sales tax: For a 1% withholding tax, 10% sales tax, and a 1,000 USD price including tax, 909.09 USD excludes tax, and this amount is the base of the withholding tax (909.09 * 1%). The system will allocate 9.09 USD to the withholding tax payable account, and 990.91 USD will be allocated to the payable account. The following diagram shows the calculation:

- Price excludes sales tax: For a 1% withholding tax, 10% sales tax, and a 1,000 ...