Chapter 3Raising Debt and Equity

In order to facilitate most acquisitions, unless cash is on hand, debt or equity needs to be raised to supply funds to acquire. A target company can also accept the acquirer's equity in a stock swap, or an exchange of shares. The OfficeMax and Office Depot merger is facilitated via stock swap; we will discuss stock swap mechanics in Part Three.

Raising funds is an important transactional first step and needs to be analyzed carefully. Will those funds come in the form of debt, or equity, or maybe some other structure? How do we analyze if it is better to raise debt or equity? We will discuss the considerations and impacts of each in this chapter.

Raising Debt

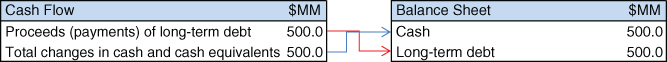

When raising debt, the initial flows are simple: Cash is received and a liability is gained. Let's assume we would like to raise $500MM in debt. For now we will consider this some type of long-term debt. Initially, debt raised affects the “Proceeds (payments) of long-term debt” line item located in the “Cash flow from financing activities” section of the cash flow statement. (See Exhibit 3.1.) This would in turn increase the “Total changes in cash and cash equivalents” line item at the bottom of the cash flow statement.

Exhibit 3.1 Cash Flow and Balance Sheet Impact on $500MM Debt Raise

Now in modeling we know that each cash flow statement line item must drive a balance sheet line item. ...

Get Mergers, Acquisitions, Divestitures, and Other Restructurings, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.