CHAPTER SEVENHedge Funds as Activist Investors

HEDGE FUNDS WERE DEVELOPED as an alternative to open-end investment funds or mutual funds. Managers of hedge funds do not make public solicitations for capital to investors in general, and as such do not face the public reporting requirements that their mutual fund counterparts do. Since hedge funds do not face as great reporting requirements, investors have more limited access to return data.

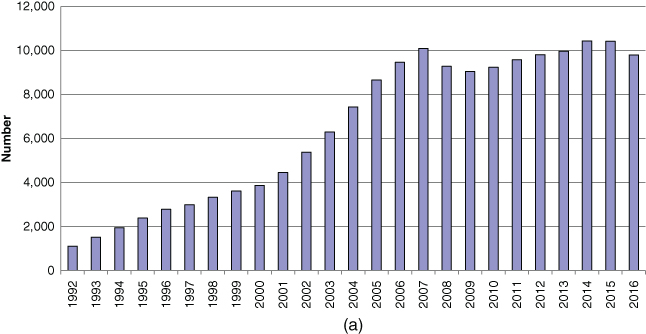

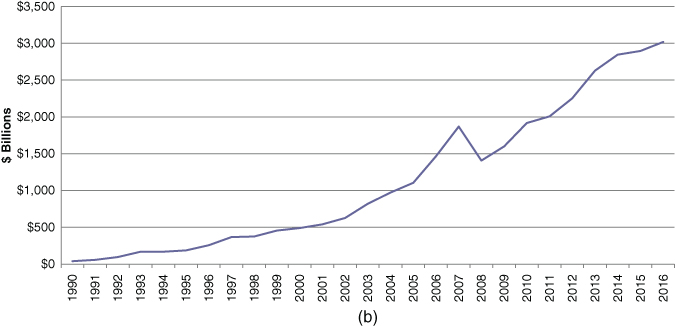

Hedge funds grew dramatically during the strong economy that prevailed over the period 2003–2007 (see Figures 7.1a and 7.2b). The number of hedge funds roughly doubled over the period 2001–2007, where they peaked at 9,550 funds. Hedge fund assets grew similarly and reached 1.87 trillion in 2007. The subprime crisis and the Great Recession caused the industry to shrink and many of the “weaker players” left the business. However, fueled by large amounts of institutional capital to invest, growth resumed in 2009 and by 2011 both the number of funds and total assets under management surpassed their 2007 levels. This growth accelerated over the years 2012–2014 only to decline in the years that followed.

FIGURE 7.1a Number of hedge funds.

FIGURE 7.1b Hedge fund assets ($ billions).

Source: Hedge Fund Research Press Release.

Within the hedge ...

Get Mergers, Acquisitions, and Corporate Restructurings, 7th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.