CHAPTER ONE Introduction

RECENT M&A TRENDS

The pace of mergers and acquisitions (M&As) picked up in the early 2000s after collapsing in the wake of the subprime crisis. M&A volume was quite strong over the period 2003–2007. This strength was apparent globally, not just in the United States. However, the United States entered the Great Recession in 2008 and the recovery from this strong economic downturn would prove difficult. A number of deals that were planned in 2007 were canceled.

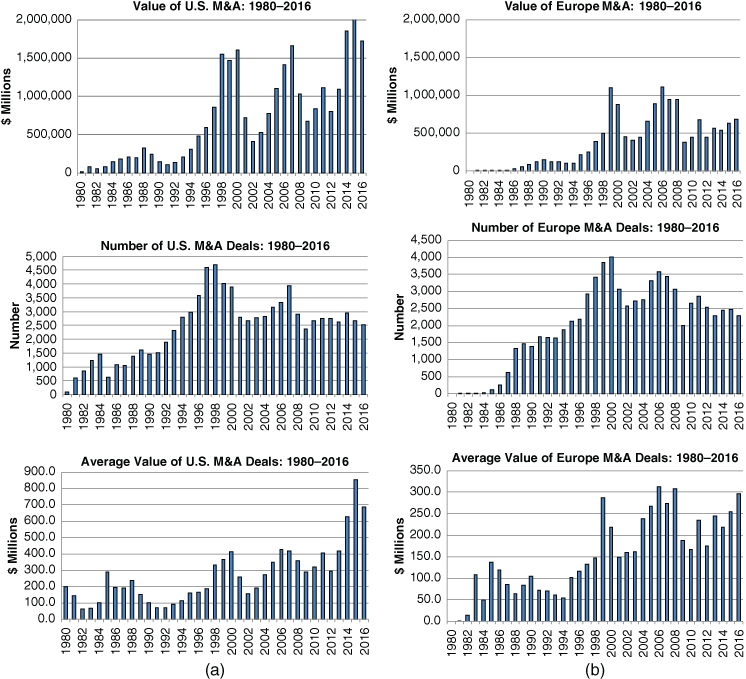

Figure 1.1 shows that the aforementioned strong M&A volume over the years 2003 to 2007 occurred in both Europe and the United States. M&A volume began to rise in 2003 and by 2006–2007 had reached levels comparable to their peaks of the fifth wave. With such high deal volume, huge megamergers were not unusual (see Tables 1.1 and 1.2). In the United States, M&A dollar volume peaked in 2007, whereas in Europe, this market peaked in 2006. Fueled by some inertia, the value of total M&A was surprisingly strong in 2008 when one considers that we were in the midst of the Great Recession. The lagged effect of the downturn, however, was markedly apparent in 2009 when M&A volume collapsed.

FIGURE 1.1 Value of M&As 1980–2016: (a) United States and (b) Europe.

TABLE 1.1 Top 10 Worldwide M&As by Value of Transaction

Source: Thomson Financial Securities Data, January 12, 2017.

| Date Announced |

Get Mergers, Acquisitions, and Corporate Restructurings, 7th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.