BACKTESTED RESULTS

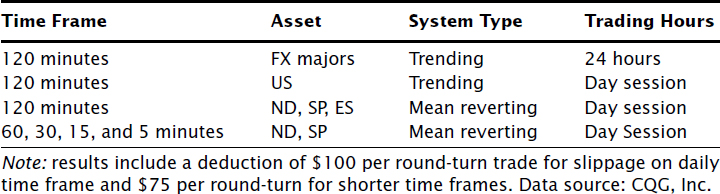

From Table 5.2 we see that only the equity indices demonstrated consistent profitability in shorter time frames. Consequently, I have decided to use only the Nasdaq 100 index in most of our studies of short-term trading vehicles. Because only corporations, banks, and institutional brokerage houses run 24-hour trading desks, I will assume that our T-bond trades occur only during CBOT pit trading hours (8:20 A.M.–3:00 P.M.) and will use cash market trading hours for equity index trades (9:30 A.M.–4:00 P.M.).

This reduction of trading hours to “day session” eliminates the assumption of a 24-hour trading desk while simultaneously ensuring superior liquidity and realistic slippage/commissions deductions. Although this means that we will miss opportunities to initiate or exit trades on the 24-hour electronic market, I believe that a robust short-term system should be able to catch a significant portion of trading opportunities.

TABLE 5.2 Assets and time frames: historical tendencies.

One positive trade-off that somewhat compensates for the loss of the vast majority of trading vehicles is a reduction in our slippage and commissions assumptions. Because we are now trading only the most liquid instruments and only during the trading hours of their greatest liquidity, we can reduce commissions and slippage deductions from $100 to $75 per round-turn trade. Although this ...

Get Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.