MEAN REVERSION INDICATOR-DRIVEN TRIGGERS: OSCILLATORS

All of the most commonly employed mean reversion indicators are oscillators. The most popular oscillators can be categorized as percentage, differential, or statistical oscillators. In all instances the goal in using oscillators is to fade a temporarily unsustainable level of market emotionalism in hopes of mean reversion. Although a mathematical technical indicator may not be able to quantify extreme emotionalism with same the consistency as an experienced trader, as long as an oscillator can be linked to a solid risk quantification mechanism, it may prove a useful tool in the trader's arsenal.

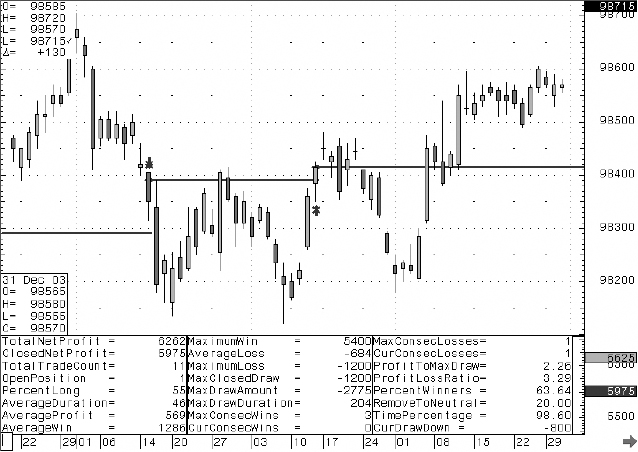

FIGURE 2.16 June 2004 IMM eurodollar with 20-day channel breakout. Results include data from December 31, 2002, to December 31, 2003.

Note: All trade summaries include $100 round-turn trade deductions for slippage and commissions. ©2004 CQG, Inc. All rights reserved worldwide.

Percentage Oscillators

Stochastics Stochastics was developed by George Lane and is based on the principle that as a market reaches temporarily unsustainable extremes, daily closing prices tend to be closer to the upper (overbought) or lower (oversold) end of each day's range. As a market loses momentum, closing prices tend to reverse these trends.

Fast %K or %K measures, on a percentage basis, where the latest closing price is in relation to the total price range ...

Get Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.