PRICE-TRIGGERED TREND-FOLLOWING INDICATORS: DONCHIAN'S CHANNEL BREAKOUT

Richard Donchian's nth period or channel breakout system is not only a price-triggered trend-following indicator, but also a comprehensive stop and reverse trading system. Trading signals are generated whenever the market price is equal to or greater than the highest high or the lowest low of the past n periods (Donchian used 20 days).11

The reason this simple trading system is so successful is that it capitalizes on one of the primary psychological flaws of novice traders: their desire to buy bottoms and sell tops. Because channel breakout only buys or sells when a trend is already established, its entry and reversal points tend to gravitate to key horizontal support or resistance levels. As the trend matures, capitulation of those seeking reversal adds to the system's profitability (see Figure 2.16).

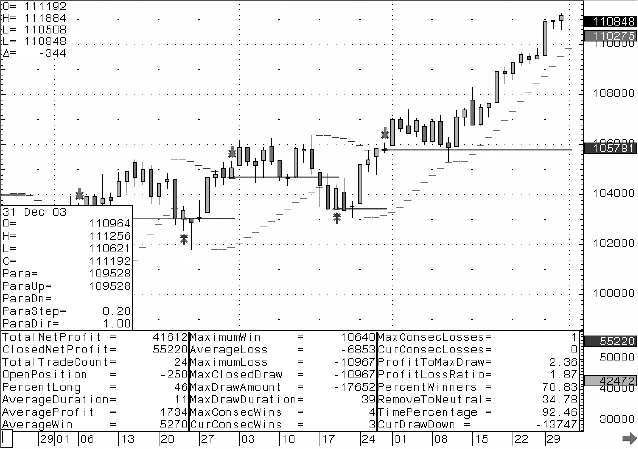

FIGURE 2.15 Cash S&P 500 × 250 with “fading” of SAR and fail-safe stop at 2.5 standard deviations beyond the 20-day moving average. Results include data from December 31, 2002, to December 31, 2003.

Note: All trade summaries include $100 round-turn trade deductions for slippage and commissions. ©2004 CQG, Inc. All rights reserved worldwide.

Get Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.