4

Equities and stock indexes

4.1 STOCKS VALUATION

The fair (theoretical) value S of a stock can be computed in different ways, none of them being fully satisfactory, hence their results are often combined to get a final result; for example, in a prospectus for an initial public offering (IPO).

4.1.1 Discounted cash flows (DCF) method

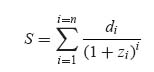

This first method uses the same rationale as for a bond valuation: the fair price is the sum of discounted future cash flows that will be paid by the stock. But here we face a succession of n unknown future dividends instead of a fixed coupon, no final maturity, and of course no repayment of a principal. Calling di the dividend paid in year i, and zi the corresponding discounting rate, the result is equivalent to the one presented for a bond price (cf. Chapter 3, Eq. 3.1):

with two issues:

- n is an a priori undetermined number of years: we cannot know how long the corporation will survive (theoretically, n goes up to ∞). Fortunately, the longer the maturity is discounted, the lower the discounted amount. So above, say, 50 years, further cash flows can be neglected in present value.

- The future dividends di are not known in advance.

The calculation is therefore valid only if referring to a realistic assumption about the future dividends.

Example. Let us consider a stock distributing a constant dividend of $5, with a constant discount rate of 5%. The ...

Get Mathematics of the Financial Markets: Financial Instruments and Derivatives Modelling, Valuation and Risk Issues now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.