Sequential trials and dealing with risk

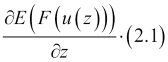

What if my preferences for making an extra few dollars outweigh the risk of losing the same amount? I will stop on why one's preferences might be asymmetric in a little while in this section, and there is scientific evidence that this asymmetry is ingrained in our minds for evolutionary reasons, but you are right, I have to optimize the expected value of the asymmetric function of the parameterized utility now, as follows:

Why would an asymmetric function surface in the analysis? One example is repeated bets or re-investments, also known as the Kelly Criterion problem. Although originally, the Kelly Criterion ...

Get Mastering Scala Machine Learning now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.