APPENDIX B

Explicit pricing of an FRN

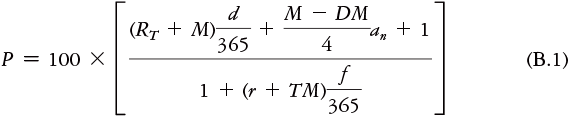

The price P of an FRN per $100 face value is given by the expression

where

- RT is the reference rate at the last coupon reset date T;

- M is the reset margin;

- DM is the discount margin;

- r is the zero rate at the next coupon payment date;

- d is the number of days in the current interest period;

- f is the number of days from settlement date to next coupon date;

- an = (1 − vn)/i;

- v = 1/(1 + i);

- i = (S + DM)/n;

- S is the annual swap rate from settlement to maturity of the FRN;

- n is the number of interest periods to maturity at the next coupon date.

Quarterly coupons and a 365-day year are assumed.

The expression ...

Get Mastering Attribution in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.