Chapter 3

The Tyranny of Past Returns

How do people decide when to invest? How do investors select among different alternatives? In virtually all investment decisions, the key driver is past returns. The investor calculus is simple: High returns are good; low returns or losses are bad. When the stock market has been rising, investor buying interest will increase. Conversely, after a period of market decline, investors will be more prone to liquidate than to invest.

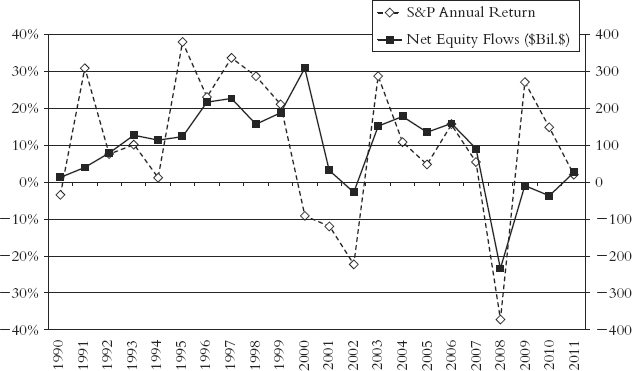

The strong relationship between market returns and investor net flows into equity mutual funds is clearly evident in Figure 3.1. When Standard & Poor’s (S&P) 500 index returns turn significantly negative, the normal inflows into equity mutual funds are reversed. Net outflows from equity mutual funds occurred in 2002 and 2008 following large declines in equity prices. In each case, equity prices surged in the following year (2003 and 2009, respectively).

Figure 3.1 Net Flows into Equity Mutual Funds (Right) versus S&P Annual Returns (Left)

Data source: S&P returns: Standard & Poor’s; mutual fund flows: 2011 Investment Company Fact Book (Washington, DC: Investment Company Institute).

Returns determine not only when people invest but also what they invest in. Investments that have registered strong two-, three-, and five-year average returns will draw buying interest, while those with low, let alone negative, returns will ...

Get Market Sense and Nonsense: How the Markets Really Work (and How They Don't) now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.