Chapter 10

Assessing company competitiveness and the portfolio matrix

Summary

To complement the analysis of segment attractiveness, it is essential that the company assesses how well equipped it is to deal with each segment before finally deciding where to focus its financial and managerial resources. However, no matter how ‘fit’ your company may be in meeting the needs of a segment, customers will make their choice based on which of the competing companies is, in their view, the ‘fittest’. It is, therefore, the company’s relative competitiveness that has to be balanced with segment attractiveness in order to determine where the greatest realizable opportunities are to be found for the organization.

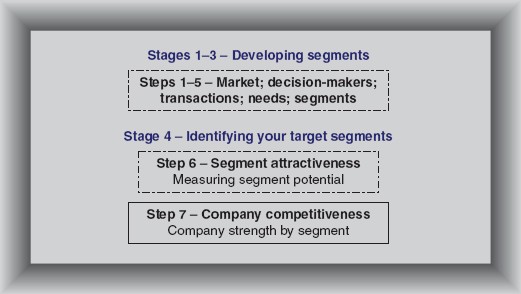

Assessing relative competitiveness and balancing it with segment attractiveness is looked at in this chapter. It is the seventh and final step in the segmentation process, as illustrated in

Figure 10.1.

In order to arrive at a realistic assessment of company strengths, it is necessary to look at the performance of companies in terms of how it is perceived by customers in relation to the needs they are seeking to satisfy. This step, therefore, requires ‘perceived’ performance as opposed to ‘true’ performance to be measured.

A term we briefly referred to in Chapter 7 and use more extensively in this chapter is ‘critical success factors’ ...