Introduction: Trading and Market Micro-structure

An on-going increase of computer-driven trading

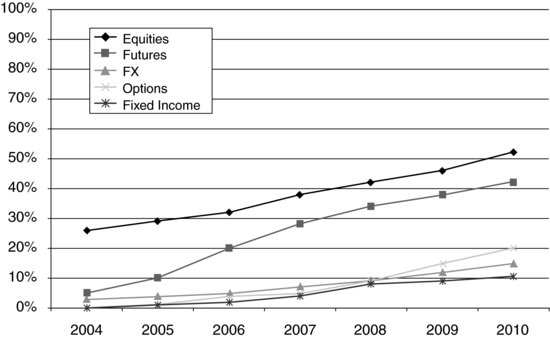

The last few years have seen dramatic changes in trading practices: the use of computers to buy and sell financial products went from zero to 25 % (depending on the asset class) in 2004 to 10 to 60 % in 2010 (see Figure 1 and Hendershott et al., 2011).

To be more accurate: “algorithmic trading” encompasses only the orders that are explicitly sent by an investor (pension fund, hedge fund, investment bank, etc.) to a server hosting trading algorithms. Three other activities should be added to these figures: “program trading” (orders that are sent as portfolios to servers), “high frequency market making” (proprietary traders providing electronic quotes in publicly available order books), and orders sent to human intermediaries who are themselves using trading algorithms to access the order books. Adding all those numbers together, at least 70 % of the trades on equity markets in the US (50 % in Europe, 35 % in Japan) are said to have a computer-operated counterpart.

Figure 1 Evolution of the use of algorithmic trading from 2004 to 2010 on US markets.

Source: Aite Group.

The main factors of these on-going changes are:

- A preference by policy-makers and regulators for transactions on electronic market transactions rather than over-the-counter ones. The main reason ...

Get Market Microstructure: Confronting Many Viewpoints now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.