Chapter 2

Job-Order Costing for Manufacturing and Service Companies

Learning Objectives

- Distinguish between manufacturing and nonmanufacturing costs and between product and period costs.

- Discuss the three inventory accounts of a manufacturing firm.

- Describe the flow of product costs in a manufacturing firm's accounts.

- Discuss the types of product costing systems.

- Explain the relation between the cost of jobs and the Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold accounts.

- Describe how direct material, direct labor, and manufacturing overhead are assigned to jobs.

- Explain the role of a predetermined overhead rate in applying overhead to jobs.

- Explain why the difference between actual overhead and overhead allocated to jobs using a predetermined rate is closed to Cost of Goods Sold or is apportioned among Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold.

- Explain how service companies can use job-order costing to calculate the cost of services provided to customers.

- Discuss modern manufacturing practices and how they affect product costing.

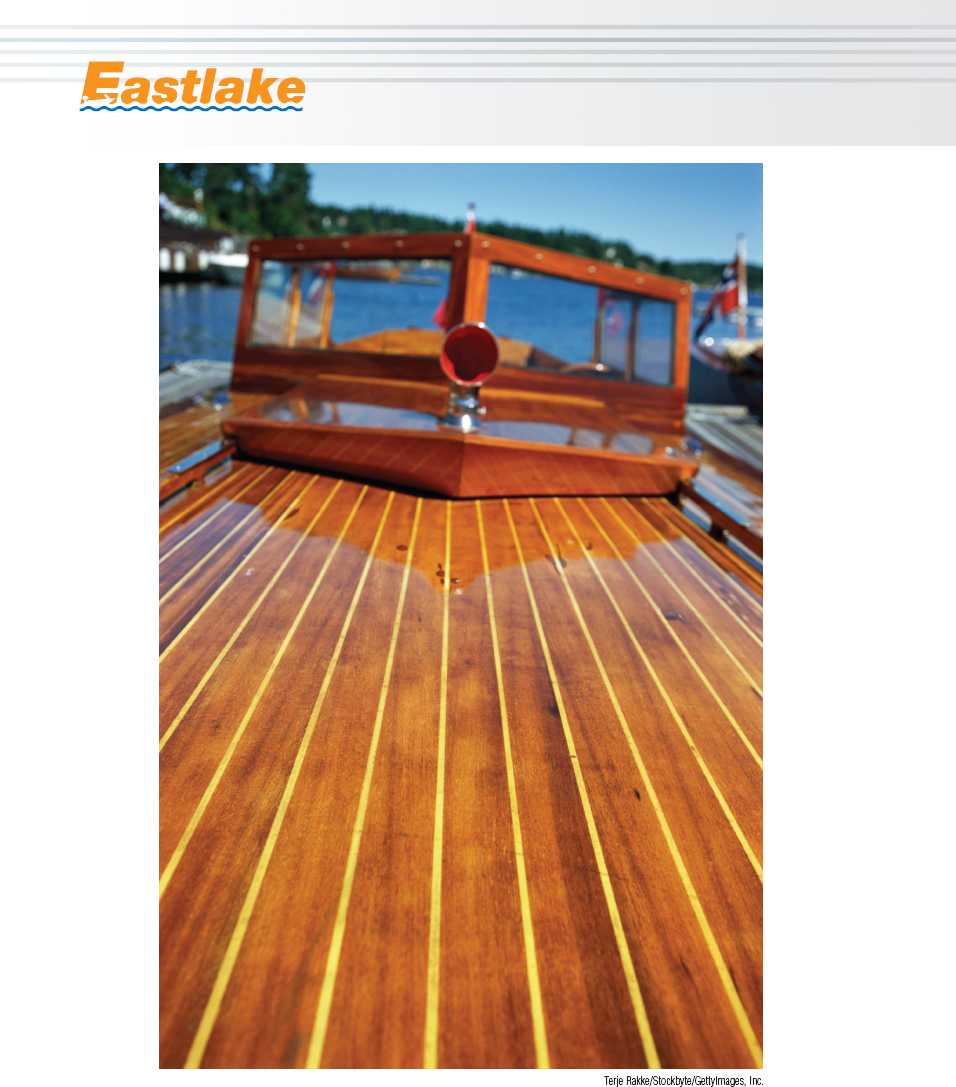

While working in the software industry, Bob Williams spent his limited free time restoring an old wooden motorboat.

After 15 years at Mayfield Software, Bob was able to retire and pursue ...

Get Managerial Accounting 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.