Chapter 1

Introduction to the IT Aspects of Mergers, Acquisitions, and Divestitures

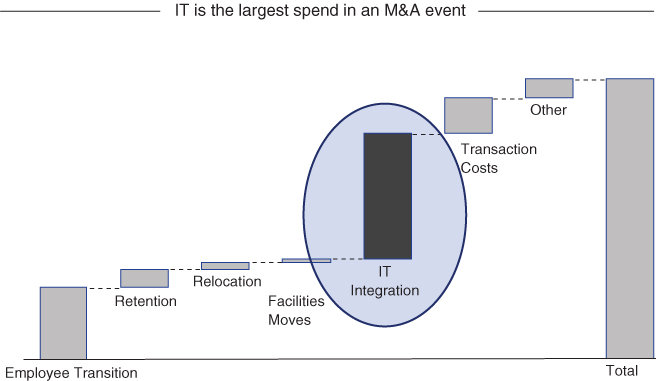

While many mergers and acquisitions (M&A) transactions fail to deliver value, a lesser-known but by some measures a more important fact is that the axis of value in mergers, acquisitions, and divestitures is more directly linked to getting information technology (IT) right than anything else. Information technology is generally the single biggest cost element in an M&A event (see Exhibit 1.1)—and can be the single biggest enabler of synergies. Getting IT involved early and often throughout the M&A lifecycle can be critical for effective execution and realization of benefits from a merger, acquisition, or divestiture.

Today, more than ever, the role of IT is under the lens as significant simultaneous disruptive forces are altering the technology landscape, and expectations are higher than ever from IT to enable changing business demand patterns. Disruptive technologies such as cloud computing, social media, mobility, and big data require a fundamental shift in the delivery and consumption of IT services. Business users now expect cheaper and more rapid deployment of technology to support business objectives through cloud computing and everything as a service (XaaS) platforms. Social technologies are enabling opportunities ...

Get M&A Information Technology Best Practices now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.