CHAPTER 3 The Need for Growth Spurs Acquirers to Buy Other Companies

The need for growth sparks companies’ desire to acquire other businesses. Growth tends to promote a higher stock price, which helps a firm to retain good employees and to sustain operations. In this chapter, we look at the 10 principal motivations.

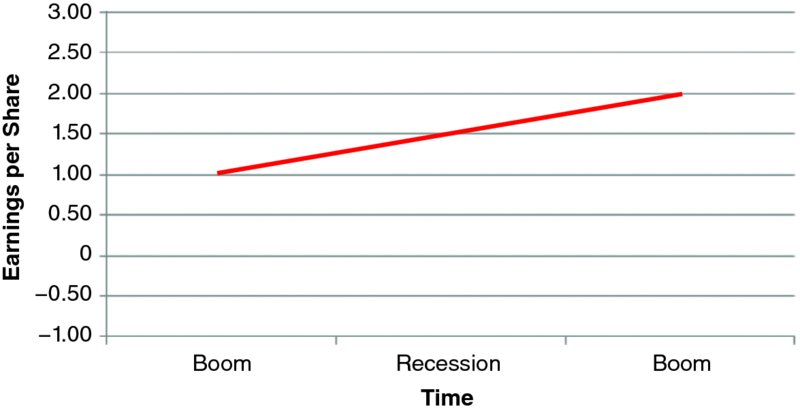

Most businesses strive for consistent increases in sales and earnings, as depicted in Figure 3.1. Upward-trending track records bring publicly traded firms higher-than-average price earning (P/E) ratios, premium stock prices, attractive financing offers, new business proposals, and many acquisition opportunities. Much of the same holds true for similarly situated private enterprises. Success breeds success.

Figure 3.1 Optimal Track Record for a Business

Companies make acquisitions in order to grow. Growth is critical to a profit-seeking enterprise for several reasons:

- Retain talent: A business needs growth in order to retain good employees. Growth provides additional promotions and rewarding compensation schemes—such as stock options—for those employees who otherwise might depart to greener pastures.

- Capital: A growth record facilitates the raising of debt and equity capital needed to sustain operations.

- Constituent confidence: A growing business imparts confidence to customers and suppliers that are vital for survival.

Fundamentally, a business has three strategies ...

Get M&A: A Practical Guide to Doing the Deal, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.