Capital asset pricing model

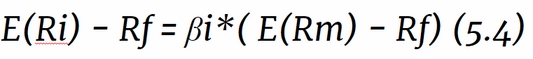

The capital asset pricing model (CAPM) model helps to gauge risk contributed by security or portfolio to its benchmark and is measured by beta (![]() ). Using the CAPM model, we can estimate the expected excess return of an individual security or portfolio which is proportional to its beta:

). Using the CAPM model, we can estimate the expected excess return of an individual security or portfolio which is proportional to its beta:

Here:

- E(Ri): Expected return of security

- E(Rm): Expected return of market

- Ri: Rate of return of security

- Rf: Risk Free rate of return

- Rm: Benchmark or market return

- : Beta of the security

CVX is regressed against DJI using linear model as per equation ...

Get Learning Quantitative Finance with R now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.