44.9 Sale of Property Used for Business and Personal Purposes

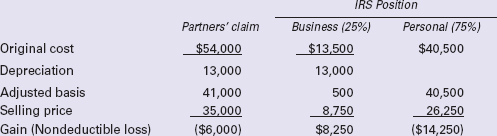

One sale will be reported as two separate sales for tax purposes when you sell a car or any other equipment used for business and personal purposes, or in some cases where a sold residence (29.7) was used partly as a residence and partly as a place of business or to produce rent income.

You allocate the sales price and the basis of the property between the business portion and the personal portion. The allocation is based on use. For example, with a car, the allocation is based on mileage used in business and personal driving.

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.