40.14 Allocating Expenses to Business Use

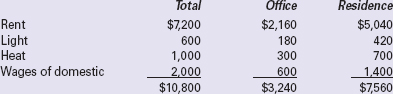

Allocate to home office use qualifying operating expenses (40.13) as follows: If the rooms are not equal or approximately equal in size, compare the number of square feet of space used for business with the total number of square feet in the home and then apply the resulting percentage to the total deductible expenses.

If all rooms in your home are approximately the same size, you may base the allocation on a comparison of the number of rooms used as an office to the total number of rooms.

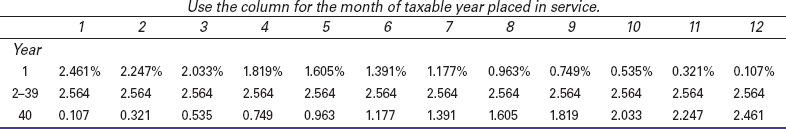

Table 40-2 Nonresidential Real Property (39 years—Property placed in service after May 12, 1993)

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.