29.8 No Loss Allowed on Personal Residence

A loss on the sale of your principal residence is not deductible. If part of your principal residence was used for business in the year of sale, treat the sale as if two pieces of property were sold. Report the business part on Form 4797. A loss is deductible only on the business part.

Second home or vacation home.

If you sell at a loss a second home or vacation home (not your principal residence) that was used entirely for personal purposes and the sale was reported on Form 1099-S, you report the loss transaction on Form 8949 and Schedule D, even though the loss is not deductible; follow the IRS instructions. If in the year of sale part of the home was rented out or used for business, allocate the sale between the personal part and the rental or business part; report the personal part on Form 8949 and Schedule D and the rental or business part on Form 4797.

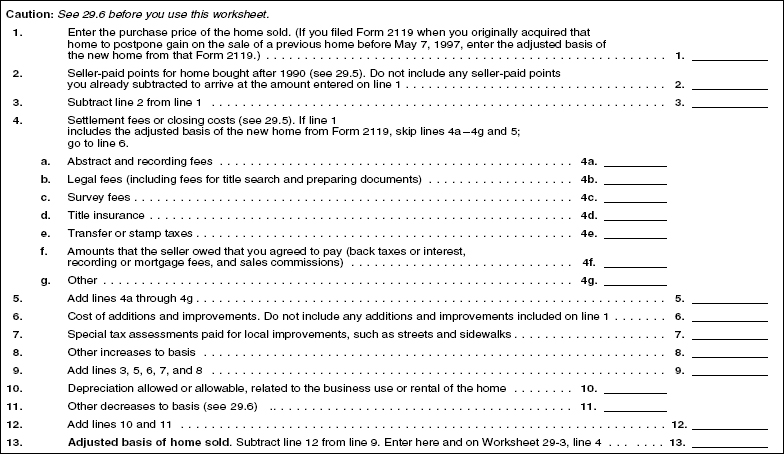

Worksheet 29-2 Adjusted Basis of Home Sold

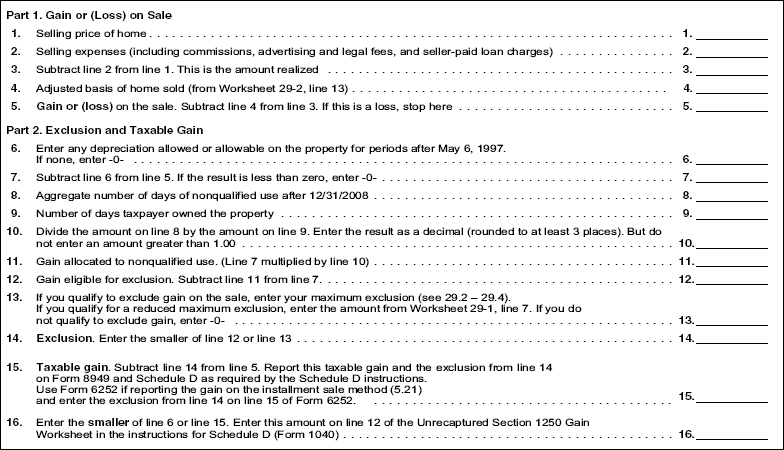

Worksheet 29-3 Gain (or Loss), Exclusion, and Taxable Gain

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.