Chapter 2Past Financial Crises and Their Causes

Financial crises have been around as long as people and societies have been engaged in trade. A look back at history shows a past littered with financial crises. Some were mild and limited in their spread and duration, while others were severe and affected many other countries.

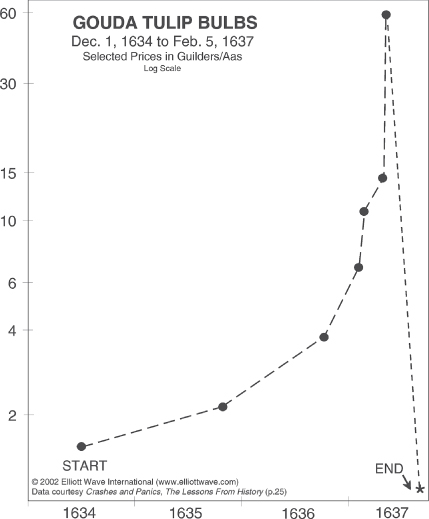

The earliest recorded financial crises occurred during the Roman and Byzantine empires. Wars and periodic droughts drained government resources, forcing the treasuries to raise taxes on the populace in order to maintain their vast empires. This not only led to a widening of the gap between rich and poor, but also led to the ultimate decline of these empires. Centuries later, with the expansion of global trade, which was facilitated by the development of financial instruments such as promissory notes and bills of exchange (as discussed in Chapter 1), financial crises started to occur more frequently. One of the earliest known crises during this period of trade expansion was the Dutch tulip mania, which began in 1634 and ended in 1637 (Figure 2.1).

Figure 2.1 Tulip bulb price in guilders from 1634 to 1637

Source: Elliott Wave International

The dominance of global trade at the time by the Dutch East India Company brought new and exotic goods to Holland. One such exotic item was the tulip brought over from Austria by way of the Ottoman Empire. Trading in ...

Get Islamic Finance and the New Financial System: An Ethical Approach to Preventing Future Financial Crises now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.