CHAPTER 13

Dividend Discount Models

In the strictest sense, the only cash flow you receive when you buy shares in a publicly traded firm is a dividend. The simplest model for valuing equity is the dividend discount model (DDM)—the value of a stock is the present value of expected dividends on it. While many analysts have turned away from the dividend discount model and view it as outmoded, much of the intuition that drives discounted cash flow valuation stems from the dividend discount model. In fact, there are companies where the dividend discount model remains a useful tool for estimating value.

This chapter explores the general model as well as specific versions of it tailored for different assumptions about future growth. It also examines issues in using the dividend discount model and the results of studies that have looked at its efficacy.

THE GENERAL MODEL

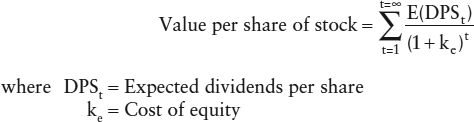

When an investor buys stock, he or she generally expects to get two types of cash flows—dividends during the period the stock is held and an expected price at the end of the holding period. Since this expected price is itself determined by future dividends, the value of a stock is the present value of dividends through infinity:

The rationale for the model lies in the present value rule—the value of any asset is the present value of expected future cash flows, discounted at a rate appropriate to the riskiness of the cash ...

Get Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, Third Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.