CHAPTER 7

How to Build Mutual Fund Portfolios for Lifetime Profits

In Part One, I discussed the importance of determining your stock allocation and offered some general guidelines on your equity exposure. Working within these guidelines, you first need to decide how much of your equity allocation should go into index funds and how much into actively managed funds.

However, to make my asset allocation suggestions simpler to understand, and to provide an important overview, I have summarized them in an all-index fund portfolio. Later, I'll show you how to introduce some actively managed funds into your mix. All are long-term recommendations. The purpose of these models is to provide both insights and solutions. The insights are more important.

Lifetime All-Index Fund Portfolio

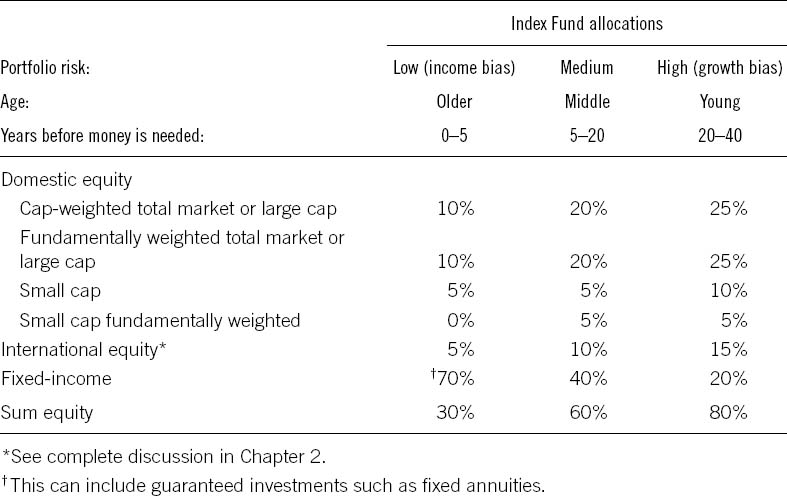

The following table categorizes investors by their willingness to accept risk, but the Low, Medium, and High categories could just as easily be considered stages of life—or the number of years before the money is needed.

I've divided domestic index funds into two categories, capitalization weighted and fundamentally weighted (which I'll explain in the next chapter). For the purposes of this table, I include cash/equivalents earmarked for long-term investing as part of the fixed-income component. Cash for everyday use and an emergency cash reserve are separate.

Consider the percentages in the table as midpoints ...

Get Investing without Wall Street: The Five Essentials of Financial Freedom now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.