APPENDIX I

Parties to Transaction

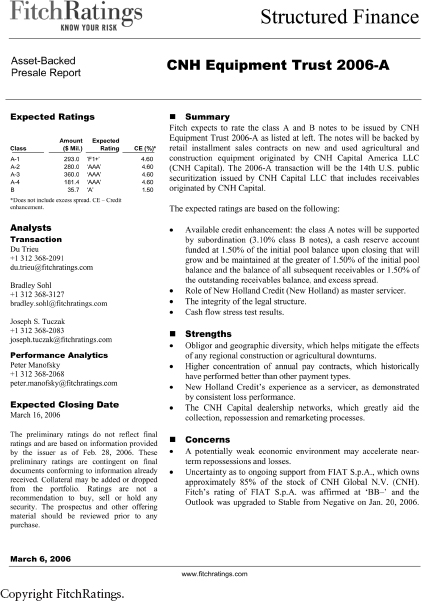

Sponsor/Originator: CNH Capital America LLC.

Servicer: New Holland Credit Company, LLC.

Backup Servicer: Systems & Services Technologies, Inc.

Indenture Trustee: JP Morgan Chase Bank.

Trustee: The Bank of New York.

■ Noteworthy Changes

- Decline in Enhancement Levels: Initial enhancement has been reduced by 65 basis points (bps) for the class A notes and 125 bps for the class B notes from the closing levels in the CNH 2005-B transaction. The 2006-A transaction will not include a class C tranche, which provided subordination for the class A and B notes in the prior transactions. These reductions in enhancement are the net result of changes in the size of the class B notes (decrease of 60 bps), removal of class C notes (decline of 100 bps) and a reduction in the reserve account of 25 bps. When sizing enhancement levels, Fitch took into consideration, among other things, the continually improving static-loss performance of both new and used agricultural and construction equipment, the collateral characteristics and certain structural features of the 2006-A transaction. These features include a $387 million prefunding amount (approximately 33.6% of initial receivables). Fitch notes that, given the size of the prefunding amount, the addition of new loans should not significantly affect closing date pool characteristics and concentrations.

- Shifting Payment ...

Get Introduction to Structured Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.