LEARNING EXTENSION 10

Annualizing Rates of Return

An investment provides two sources of returns: income and price changes. Bonds pay coupon interest (income), and as we saw in Chapter 10, fluctuating market interest rates can lead to changing bond prices and capital gains or losses. Stocks may pay dividends (a source of investor income) and rise or fall in value over time, leading to capital gains or losses. Such is the case with other investment vehicles such as real estate or mutual funds.

HOLDING PERIOD RETURNS

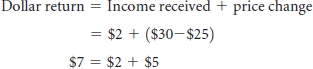

The dollar return on a single financial asset held for a specific time, or holding period, is given by the following:

![]()

Suppose during the time, Amy held a share of stock, and she received dividends of $2 while the stock price rose from a purchase price of $25 to its current level of $30. Should Amy sell the stock today, her dollar return would be the following:

She received $2 in dividends and the value of her investment rose by $5 for a total dollar return of $7. To compare this investment return with others, it is best to measure the dollar return relative to the initial price paid for the stock. This percentage return is the dollar return divided by the initial price of the stock:

Amy's percentage return was the following:

ANNUALIZED RATES OF RETURN

To compare the returns ...

Get Introduction to Finance: Markets, Investments, and Financial Management, 15th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.