11 Revenues and Expenses

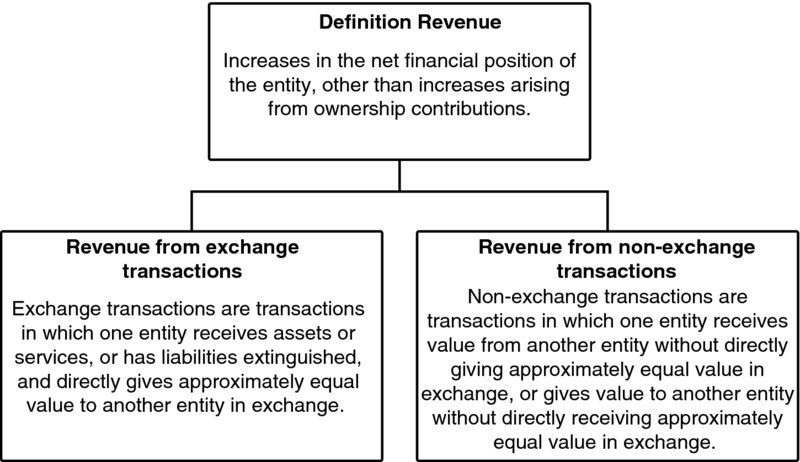

This chapter will consider revenue and expense recognition under IPSAS. Public sector entities can derive revenue from exchange and non-exchange transactions (see Figure 11.1). IPSAS 9 Revenue from Exchange Transactions is the current standard to be applied when determining how and when revenue should be recognized for exchange transactions. IPSAS 9 sets the principles for the recognition of revenue arising from the sale of goods and the rendering of services. IPSAS 23 Revenue from Non-Exchange Transactions (taxes and transfers) prescribes the requirements for accounting and reporting for revenue arising from non-exchange transactions. Common sources of non-exchange revenue in the public sector include taxes and transfers. The difference between exchange and non-exchange transactions is the substance rather than the form of the transaction. It should also be noted that within the public sector, revenue transactions can include both exchange and non-exchange components. IPSAS 11 on Construction Contracts sets out the principles for the recognition of revenue arising from long-term construction contracts. In order to cover the accounting for revenue-generating transactions, this chapter will include IPSAS 23, IPSAS 9, and IPSAS 11. The IPSASB Conceptual Framework and IPSAS 1 provide the definition of revenue1 (see Figure 11.1) and expenses.

Get Interpretation and Application of IPSAS now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.