Chapter 6

Private equity fund accountinga

6.1 WHAT IS HAPPENING IN PRIVATE EQUITY ACCOUNTING?

Private equity as an industry and as an asset class has “grown up” significantly over the last 20 years. This maturing of the industry has pushed private equity and venture capital from a quiet and veiled corner of the room, where it was regarded as a poor relation to the wider asset management family, to center stage. This transformation has brought with it many strains and stresses from public accountability through all areas of governance to reporting.

In essence the private equity and venture capital (“private equity”) business model is relatively simple. It is to invest pooled funds in assets that are typically not liquid to generate returns for the investors.

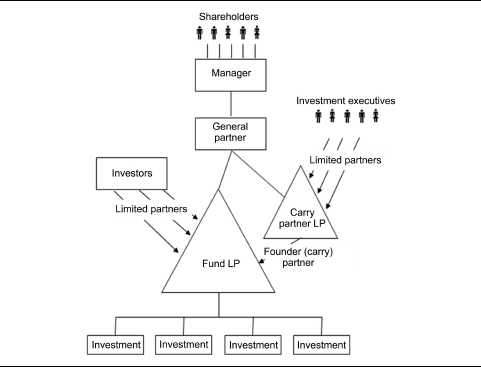

This chapter focuses on the accounting issues encountered in the U.K. private equity environment. Due to the many different detailed business models which fall under this simple business idea, it would be impossible to cover all the potential eventualities which may arise in a business designated as private equity. This chapter focuses on accounting common in the U.K., principally from the point of view of the most commonly used fund structure presented in Exhibit 6.1.

EXHIBIT 6.1 MOST COMMONLY USED FUND STRUCTURE

This chapter sets out the principles of and rationale behind accounting from the perspective of U.K. GAAP and ...