CHAPTER 12 Central Banks as Lenders of Last Resort Have a Conflict of Interest with Their Regulatory Role

“I know that it is fashionable to talk about a ‘dual mandate,’ that policy should be directed to price stability and full employment. Fashionable or not, I find that dual mandate both operationally confusing and ultimately illusionary.”

—Paul Volcker, Former Federal Reserve President

Since 2008, central banks have been the main source of liquidity when distrust between banks and financial institutions threatened financial stability and the financing of the economy. On top of that liquidity intervention, they effectively took credit risks that should never have been theirs and massively increased the size of their balance sheets.

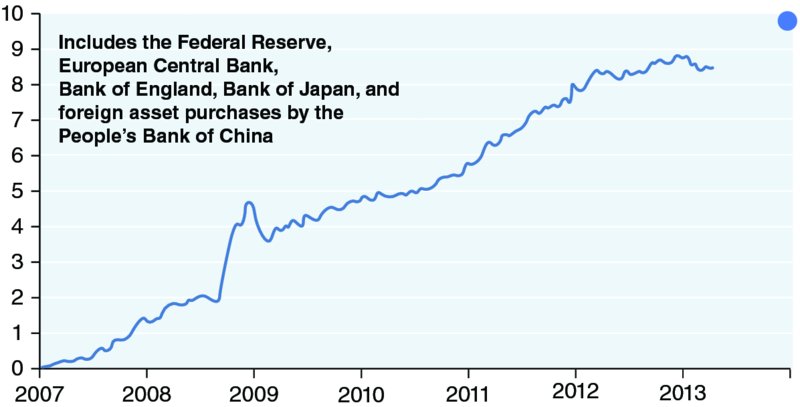

This marks a profound evolution of central banking, and has implications on the nature of its role. It will require a complete rethinking of the role of central banks that have been accused of acting more in favor of the banks than the economy as a whole. It seems obvious that the $9 trillion increase of the balance sheet of the main central banks since 2007 cannot be sustained without a reanalysis of their role (see Figure 12.1).

FIGURE 12.1 Earth Nebula, Change in Central Bank Balance Sheets since January 2007 (Trillion $)

Sources: Federal Reserve, Bank of Japan, Bank of England, European Central Bank, People's Bank of China, J. P. Morgan ...

Get International Finance Regulation: The Quest for Financial Stability now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.