CHAPTER 10 Banking and Shadow Banking

“On its own, a bank capital requirement has the effect of pushing intermediation into the shadow banks, leaving a vulnerability if that sector becomes overleveraged.”

—Bank of England Former Deputy Governor Paul Tucker

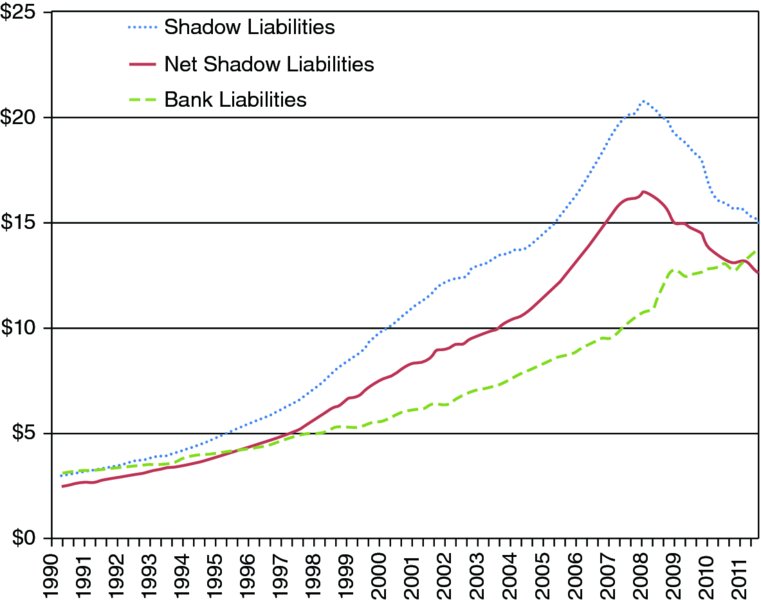

As new regulations are affecting banks and a variety of regulators affect their ability to operate, banks will need more equity and will not be able to grow as fast as they did. This evolution will fuel the development of alternative sources of financing (see Figure 10.1).

FIGURE 10.1 Shadow Bank Liabilities vs. Traditional Bank Liabilities (in $ trillions)

Source: Flow of Funds Accounts of the United States as of 2011: Q3 (FRB) and FRBNY. www.ny.frb.org/research/staff_reports/sr458.pdf.

What we learned from the financial crisis is that even shadow banking cannot be left unregulated, and requires some form of oversight and rules. The sense of urgency is increasing as we realize that the needs of the economy are growing again while the capital adequacy and liquidity ratios of Basel III might make financing less readily available from the banking sector.

The question is therefore not to banish or eradicate shadow banking. This is particularly true for Europe, where the bulk of the financial needs of the economy are provided by commercial banks through loans rather than from capital markets through securities financing. ...

Get International Finance Regulation: The Quest for Financial Stability now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.