CHAPTER 2 A Quarter Century of Banking Crises and the Evolution of Financial Institutions

“The crisis has resulted from a confusion about the appropriate roles of the government and the market. We need to find the right balance again, and I am hopeful we will.”

—Reserve Bank of India Governor Raghuram Rajan

In May 2007, on both sides of the Atlantic Ocean, two crises erupted, in Europe and in the United States, and central banks stepped in to avoid a systemic crisis. It was the first evidence that markets were so interconnected that the impact of problems in a major country immediately affects the global markets.

Within a week, information hit the market in the United States and in Europe, and both the Federal Reserve ($30 billion)1 and the European Central Bank2 (€95 billion [$ 135 billion]) had to intervene on Friday, August 10, 2007.

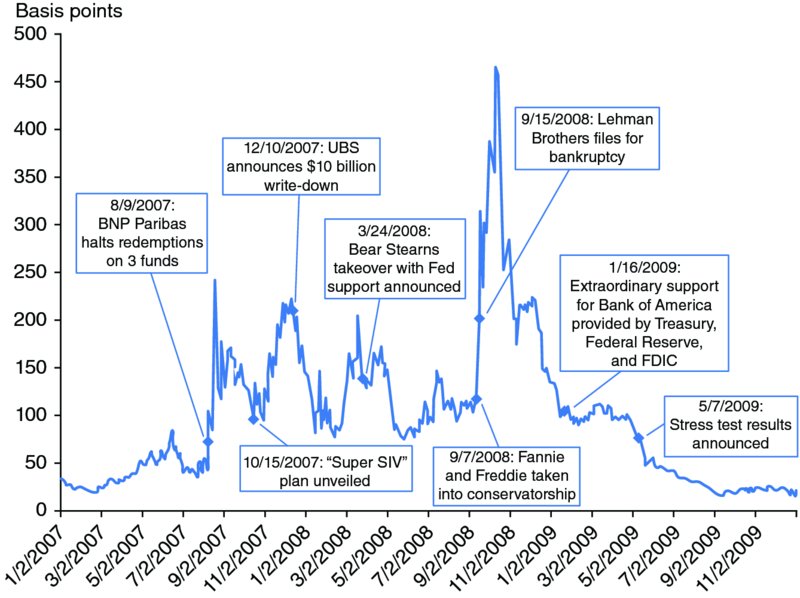

One of the most spectacular and dramatic market indicators is the three-month Eurodollar (TED) rate that measures the spread between U.S. Treasuries and the Eurodollar market for the same 90 days’ maturities (see Figure 2.1). U.S. Treasuries benefit from the interest rate management of the Federal Reserve, while the Eurodollar rate was “free” to fluctuate purely on supply and demand.

FIGURE 2.1 Three-Month TED Spread

Source: Federal Reserve Bank of St. Louis FRED database.3

The London interbank offered rate (LIBOR) was therefore the key ...

Get International Finance Regulation: The Quest for Financial Stability now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.