Chapter 3

Fixed Income Markets

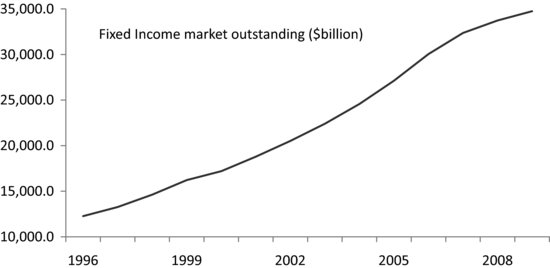

The fixed income market forms one of the major asset classes for investors, along with equities, currencies, commodities, and others such as real estate. The term refers to debt markets that allow issuers to raise funds for a range of needs. This chapter provides an overview of different types of fixed income markets and their characteristics. Unlike equity markets, fixed income products generally do not offer a stake in the issuer, but instead allow the investor to lay claim to a stream of cash flows from the issuer. Fixed income markets are present globally, but the U.S. fixed income markets stand out in size and dominance. Over the years, the size of the U.S. fixed income market has increased rapidly because of increased issuance from traditional sectors such as government debt as well as the emergence of new areas such as asset-backed securities. Figure 3.1 shows the total size of the U.S. fixed income market; the aggregate amount outstanding has grown rapidly over the past decade, although this growth slowed with the 2008 credit crunch as more complex, securitized markets shrank.

FIGURE 3.1 Total U.S. Fixed Income Market Outstanding Notional

Sources: Board of Governors of the Federal Reserve, Securities Industry and Financial Markets Association.

The U.S. fixed income market has a number of subsectors that are separated by issuing entity. The ...