CHAPTER 4Controlling the Advisors

Although the ultimate responsibility for the success of a deal will rest with the board of directors and senior management, in most mergers there are a large number of advisors necessary to bring the deal to completion. Some of these advisors may be involved from the first step in the planning process through closing (and possibly even beyond), whereas other advisors will play a much more limited role during a very specific part of the merger process.

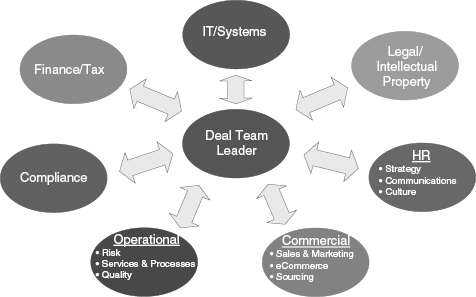

An example of the deal group from GE is shown in Figure 4.1. Some of these team members will be internal, others external, and for GE as with many firms, there will be a mix where, for example, the in-house legal team will be advised on the deal by external legal experts. Typically, the larger the company and the more frequently it engages in acquisitions, the more likely the existence of an internal team. Even in these cases, external advisors will be used when there are multiple deals simultaneously taking place or when a deal is outside the immediate area of experience or expertise of the team (say, in a new geographical area or product line).

Coordinating Advisor

Advisor roles overlap, but there are some general comments that can be made about each of the major types of advisor. The financial advisor is typically at the center and acts as the experienced coordinator ...

Get Intelligent M & A: Navigating the Mergers and Acquisitions Minefield, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.