CHAPTER 14B

INTELLECTUAL PROPERTY AND INTANGIBLE ASSET VOLATILITY (NEW)

There appears to be some question about the value of intellectual property during economic downturns. Some have suggested that the value of intellectual property and intangible assets (IP&IA) are immune to economic downturns. This is not the case, and this chapter will present simple calculations to show that IP&IA value changes with economic cycles.

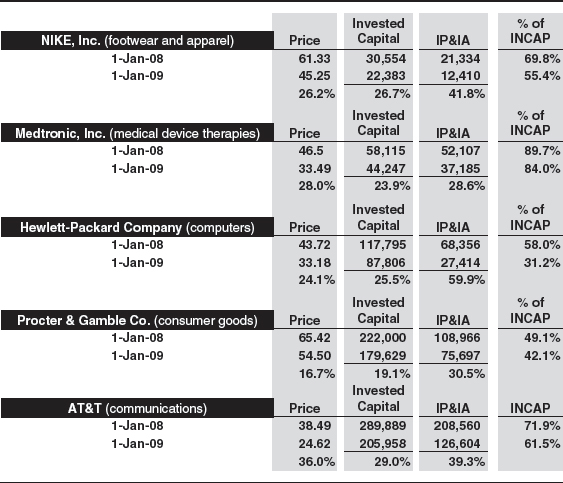

Exhibit 14B.1 of this supplement showed that in 2005 nearly 80% of the value of the S&P 500 was attributed to IP&IA. So, if the value of the S&P 500 is hit by economic cycles then the underlying value of its IP&IA is also hit. The value of corporations and their stocks is directly tied to IP&IA. In fact, the value of IP&IA dominates the value of the corporations owing them. Exhibit 14B.1 shows the value of IP&IA for five companies involved in very different industries. Included are:

- Nike, Inc. (footwear and apparel)

- Medtronic, Inc. (medical device therapies)

- Hewlett-Packard Company (computers)

- Procter & Gamble Company (consumer goods)

- AT&T (communications)

EXHIBIT 14B.1 INTELLECTUAL PROPERTY AND INTANGIBLE ASSETS VALUES

For each company a comparison of its stock price, invested capital, and the value of its IP&IA and IP&IA as a percentage of invested capital (INCAP) are shown for January 2008 and January 2009. The price of company stock has been taken from a ...

Get Intellectual Property: Valuation, Exploitation and Infringement Damages 2013 Cumulative Supplement, 11th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.