CHAPTER 6

Buyable Gap-Up Exercises

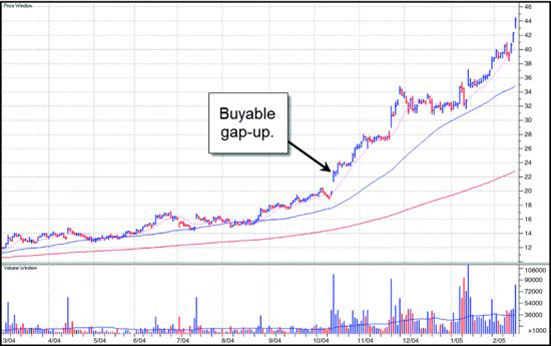

In this chapter we will exercise your chart eye with a vigorous workout identifying gap-ups that would meet the definition and required characteristics of a buyable gap-up. Buyable gap-ups often have the look of being way up there, but it is important to understand that the visual perception of a gap-up as being far too extended to the upside is often an illusion. Stocks that gap-up often have huge price moves over the ensuing weeks and months. This leads the stock's price chart to develop in such a way that the original gap-up move looks quite tiny in comparison to the overall price move of a big, winning stock over time, such as the move Apple, Inc. (AAPL) had in the last quarter of 2004 after a huge-volume buyable gap-up move in October of that year (Figure 6.1).

Figure 6.1 Apple, Inc. (AAPL) daily chart, 2004. While the original gap-up move may appear too high at the time, the stock's eventual upside price move can dwarf the original gap-up that got the ball rolling in the first place.

Chart courtesy of HighGrowthStock Investor, © 2012, used by permission.

In each of the exercises that follow, decide whether you would buy the gap-up move shown in the chart. Discuss the reasons for buying or not buying the stock.

Chart courtesy of HighGrowthStock Investor, © 2012, used by permission.

Chart courtesy of HighGrowthStock Investor, © 2012, ...

Get In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.