7

SHARE-BASED COMPENSATION

IDENTIFICATION OF A SHARE-BASED COMPENSATION PLAN

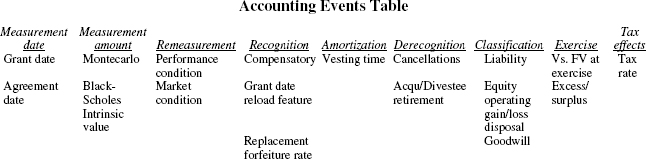

The accounting and reporting for share-based compensation (SBC) plans is one of the most difficult and subjective areas. Every transaction in the life cycle of the plan—measurement date, measurement amount, recognition, amortization, derecognition, balance sheet classification, exercise, and tax effects—requires multiple inputs, assumptions, and judgment.

Below is a table that lists the major events in the life cycle of SBC plans with the operational variables that affect them.

The first issue in accounting for SBC plans is to assess whether an entity has a share-based compensation plan. Under IFRS, if employees or others (vendors, directors) receive shares, options, or other instruments based on an entity’s shares, except in rare circumstances, a company is considered to have an SBC plan. Under US GAAP, certain criteria must be met. For large-scale programs, criteria include an assessment of the relative amount of price reduction a recipient can receive from the general market participants. Generally, IFRS and US GAAP are similar in terms of whether the entity has an SBC plan (the accounting is different in several respects, which will be covered later).

Under both standards, share-based compensation can be awarded to employees and nonemployees. IFRS also extends the accounting for employees to parties ...

Get IFRS and US GAAP, with Website: A Comprehensive Comparison now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.