Glossary

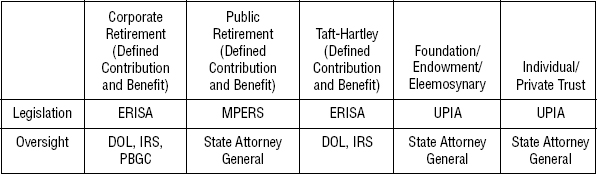

The following chart breaks down the type of fiduciary accounts or entities to help organize and understand how legislation and oversight are overlaid.

401(k) plan

A defined-contribution plan that permits employees to have a portion of their salary deducted from their paycheck and contributed to an account. Federal (and sometimes state) taxes on the employee contributions and investment earnings are deferred until the participant receives a distribution from the plan (typically at retirement). Employers may also make contributions to a participant’s account.

404(c)

Known as the “safe harbor” clause, this section of the ERISA regulations limit the liability of the Plan fiduciaries for the results of the participant’s exercise of control by:

- Notifying participants that a 404(c) plan is constituted, including a statement that fiduciaries of the plan may be relieved of certain liabilities.

- Providing participants at least three investment options that each have a different risk/return profile.

- Providing participants with sufficient information so the participant can make an informed decision about his or her selection of investment option(s).

- Permitting participants to change investment options on a daily [quarterly] basis. Because each plan participant shall make investment contribution and allocation decisions, the Committee shall refrain from giving what could be construed ...

Get How to Write an Investment Policy Statement, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.