CHAPTER 3

Vanilla Instruments

3.1 DEFINITIONS

Financial assets may be roughly classified, according to the payoff, into three categories:

- Fixed income

- Derivatives

- Variable income.

The financial instruments presented in this book relate to assets with:

- predetermined cash flow payment dates

- revenues that can be modelized.

This excludes variable-income instruments, such as equities that bear random coupons: stocks will solely be accounted for as underlying assets involved in equity-related derivatives.

3.2 FIXED INCOME

For this class of assets, the calculation of the fair value is straightforward. Since cash flows and payment dates are predetermined at inception, the present value of the future flows is easily obtained, provided that a relevant yield curve is available for the calculation of the discount factors.

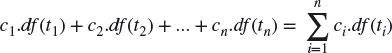

Let us denote by dfi these discount factors: the theoretical value of an asset paying n coupons ci, i = 1…n writes:

It is common to figure payments on a cash flow chart: each flow is represented by an arrow pointing either to a time line (inflows) or out of it (outflows). Practically, it implies that this kind of chart is drawn from the point of view of one counterparty. As an example, the n coupons received by an investor in a bond can be figured as below:

In a fair ...

Get How to Implement Market Models Using VBA now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.