Chapter 14Strategies

CALL

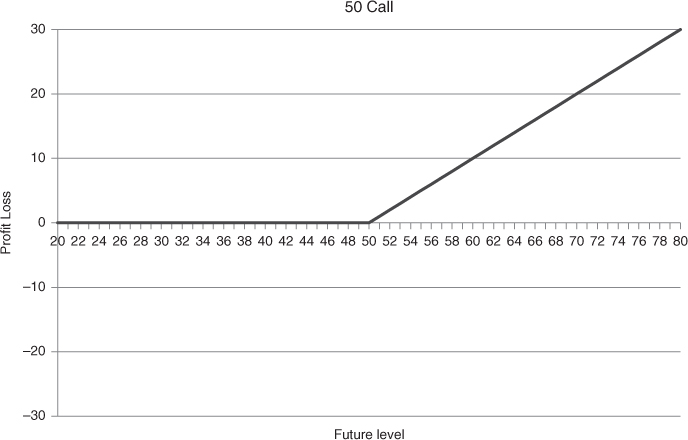

The buyer of the 50 call is aiming for the market to increase in order to generate a profit. For each dollar higher than 50 at expiry he will earn $1, as shown below in Chart 14.1. The initial investment will need to be deducted. He is long gamma and vega, losing value because of the time decay. However, he is not bothered by the Greeks. His sheer interest is the Future moving up to higher levels. Obviously, when selling it without a hedge the trader must have a strong view on the market, The Future will have to trade either sideways or towards lower levels.

Chart 14.1 50 Call at expiry

When the delta of the option is hedged, it is a completely different story. The buyer, when being long the option, has an exposure in gamma, vega and theta. He must have the conviction that volatility is too low valued or he believes in a trend (in either direction) in which he applies a wide hedging strategy on the back of his gamma. He will be bleeding when the market is sideways. The seller must see the volatility as being overprized and at the same time believe that the market is sideways. When the market is trending he will have difficulties in preventing losses on his position. The safest thing for him will be to apply a tight(-ish) gamma hedging strategy.

One should be aware that when the call is hedged for a delta of 50% one actually buys a straddle. When ...

Get How to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to Vega now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.