Chapter 13Butterfly

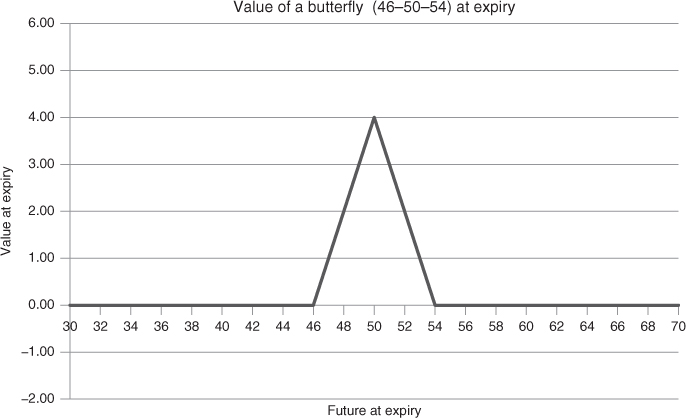

A butterfly is a structure where one buys the wings of an option combination once and sells the middle twice: for instance, a 46–50–54 put butterfly can be set up by buying the 46 and 54 put once and selling the 50 put twice. This specific structure is defined as a long butterfly.

The maximum payoff at expiry will be when the underlying is exactly in the middle at the short strike. Obviously, when the butterfly is short, it will be the maximum loss level.

In Chart 13.1 the 46–50–54 butterfly at expiry is depicted, the strategy will be set up by:

Chart 13.1 Profit Loss distribution of a 46–50–54 butterfly

| Buying | 46 Strike | Once |

| Selling | 50 Strike | Twice |

| Buying | 54 Strike | Once |

The butterfly, set up with calls, will be the same as a butterfly set up with puts: the P&L distribution will be exactly the same.

When set up with put options, as shown in Table 13.2, at any level above 54, no put has any value and thus the value of the butterfly is zero. When expiring between 54 and 50 the 54 put will generate a profit, maximised at $4 when the market expires at 50. Below 50 the owner of the butterfly will be net short one put (long 54 once, short 50 twice) and up to the 46 level the $4 value will have decreased to zero again. Below 46 the owner of the butterfly has a balanced portfolio in long/short strikes and hence the value cannot decrease ...

Get How to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to Vega now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.