Chapter 4Put Call Parity

Many people might look surprised when overhearing the phrase: “call is put and vice versa”, but the truth is that calls and puts are directly related to each other and are “interchangeable”. Discrepancies in this relationship can be easily arbitraged. The relationship also says something about the Greeks; when calls and puts are “interchangeable” and when arbitrage opportunities might arise when there are discrepancies, most of the Greeks (gamma, vega, theta) should be identical as well.

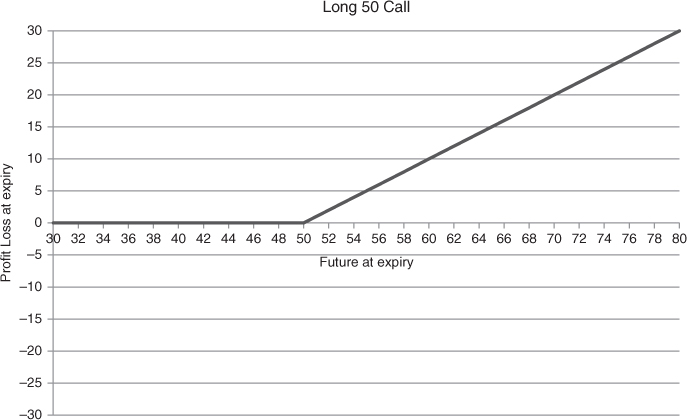

This chapter will describe how put call parity works and how, through so-called synthetics, calls can be converted into puts and vice versa. Firstly, a very obvious simple reflection of calls, puts and Futures is presented. Profit and loss charts of each one, long and short at 50, is shown.

A long 50 Call , as shown in Chart 4.1 on the previous page, at expiry obviously has no value when the Future is below 50. Anything above 50 is called intrinsic value and brings a straight profit (not taking the initial premium paid into account). The profit above 50 will be the Future level minus the strike level F − K. So at 75 for instance, the profit of the option is $25 and so on.

Chart 4.1 Long the 50 call

A short 50 call will look as follows:

With a short 50 call, as shown above in Chart 4.2, at expiry, any level above 50 in the Future will create a loss in the option, equivalent ...

Get How to Calculate Options Prices and Their Greeks: Exploring the Black Scholes Model from Delta to Vega now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.