Preface

This book is a practical introduction to modelling and analysing hedge funds using the popular Excel spreadsheet tool and Visual Basic for Applications (VBA) programming language. The structure of the book is as follows. Chapters 1–3 cover the necessary foundations required in order to understand hedge funds and the alternative investment industry. With this fundamental knowledge in place, Chapters 4–7 cover the more quantitative and theoretical material needed to effectively analyse a series of hedge fund returns and extract the relevant information required in order to make critical investment decisions.

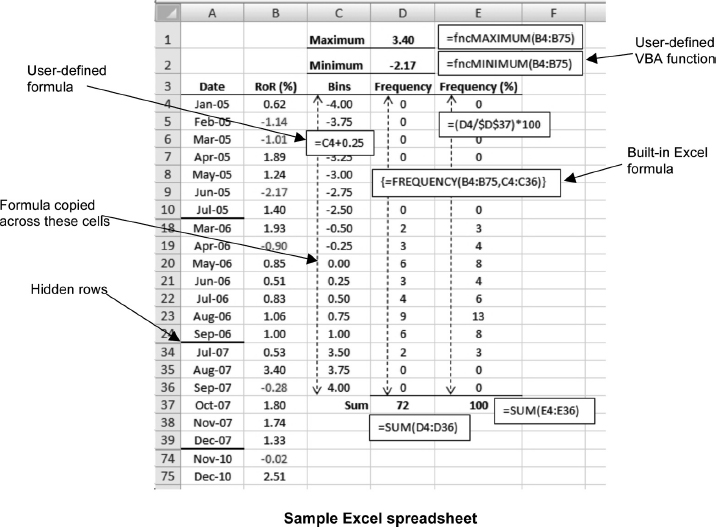

Throughout the book there are numerous snapshots of Excel spreadsheets and VBA source code. These are described as follows.

EXCEL SPREADSHEETS

The book assumes a working knowledge of Excel, with an ability to implement simple built-in functions, such as SUM(), AVERAGE() and STDEV(), and build dynamic spreadsheets. The following example schematic explains how to interpret an Excel spreadsheet snapshot within the book:

EXCEL AND USER-DEFINED VBA FUNCTIONS

When a built-in Excel function is used in the book, a description of the use of the function is provided, where necessary, in the text or in a footnote. For example, if an Excel spreadsheet makes use of the NORMSINV() built-in Excel function, a brief description is given in a footnote.1 All user-defined functions are implemented ...

Get Hedge Fund Modelling and Analysis Using Excel and VBA now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.