Non-CRRA Preferences

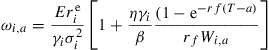

Non-CRRA preferences may generate rebalancing over the life-cycle. For instance, if individuals have hyperbolic Bernoulli utility

![]()

Merton (1971) shows that the optimal portfolio risky share depends on age even without labor income:

(4.2)

(4.2)

With ![]() , older investors take less financial risk than the young. Gollier and Zeckhauser (2002) consider a general characterization of risk tolerance and show that departure from linearity generates ...

, older investors take less financial risk than the young. Gollier and Zeckhauser (2002) consider a general characterization of risk tolerance and show that departure from linearity generates ...

Get Handbook of the Economics of Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.