21.4 What Execution Strategies are Most Effective?

As a general rule of thumb, if your trading goals and performance are centred on targeting specific market levels or taking advantage of short-term volatility, then risk pricing or aggressive algorithms are the only way to execute. For more strategic or passive trades, the adoption of algorithms is likely to enhance your bottom line.

Fredrik Wingren from Informed Portfolio Management (IPM) in Stockholm has extensive experience running FX algorithms for execution. “As a systematic model driven asset manager, minimising slippage is a key element in reducing transaction costs. With IPM's medium-long term investment approach, it makes little sense to execute as a block trade and pay a premium. Rather, we rather use algorithms to adapt to the size and speed of the execution in actual liquidity conditions and accept the volatility risk over the longer execution period.”

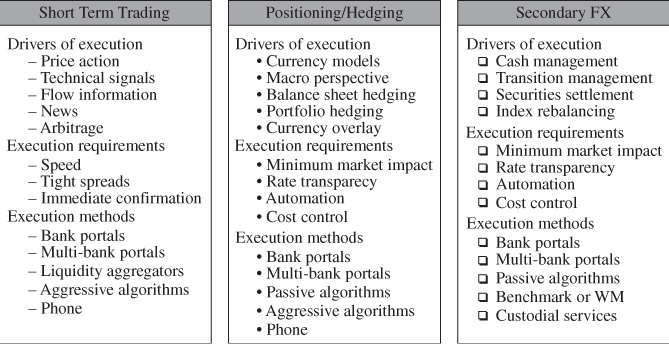

Figure 21.9 details the range of drivers of execution and the optimal execution methods assigned to them.

Figure 21.9 Identifying your execution needs.

21.4.1 Measuring Performance

Transaction cost measurement in FX is still a subjective process in many institutions and in some cases almost ignored. Running algorithms provides traders and asset managers with a framework within which they can begin to accurately gauge the most cost-effective approach to execution. Having ...

Get Handbook of Exchange Rates now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.