16.5 Trend-Following FX Indices from Banks

In the previous section, we discussed various bank indices on FX carry. Here, we do something similar, but comparing the various trend-based indices available from various banks. As with the carry indices, the precise trading rules differ between these indices. The trend indices we shall investigate are CitiFX Beta G10 Trend, Nomura Storm FX Trend, CS FX Metrics Momentum, and Barclays Adaptive FX Trend. The general idea of these indices is to use price momentum to buy and sell currencies. We compare these against our generic trend model which we described earlier in the document.

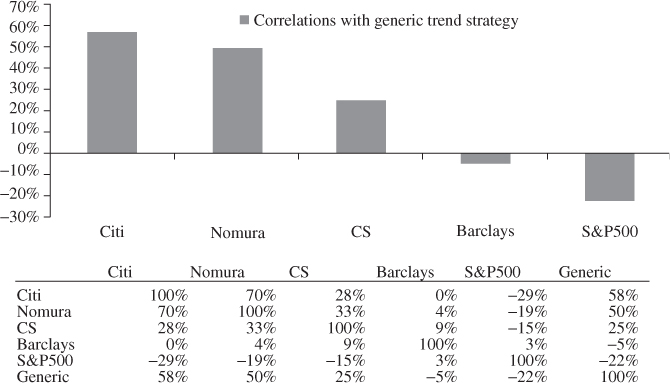

In Exhibit 16.16, we have plotted the long-term correlations among the various trend strategies to one another and also the S&P500. We see that on a long-term basis our generic strategy is anti-correlated to S&P500. The Citi, Nomura, and CS indices have large positive correlations with our generic trend-following strategy. Interestingly, the Barclays strategy exhibits very little correlation on a long-term basis with any of the other bank indices and the generic trend strategy.

Exhibit 16.16 Monthly long-term correlations between various trend indices and generic trend strategy (top) correlations between various trend strategies (bottom).

In Exhibit 16.17, we look at the 3M rolling correlations between some of the various bank trend indices versus our generic ...

Get Handbook of Exchange Rates now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.