3

Convertible Bonds and Mandatory Convertible Bonds

This chapter examines the major characteristics of convertible bonds and mandatory convertible bonds. It covers the terminology, structures and price behavior of these instruments, as well as issuer and investor motivations. Also in this chapter, contingent convertibles – FRESHES, CASHES and ECNs – are covered in detail. Several real case studies are included: a convertible bond issued by the German corporate Infineon, a mandatory convertible bond issued by UBS, a FRESH issued by Fortis Bank, a CASHES issued by Unicredit and an ECN issued by Lloyds.

3.1 INTRODUCTION TO CONVERTIBLE BONDS

3.1.1 What are Convertible Bonds?

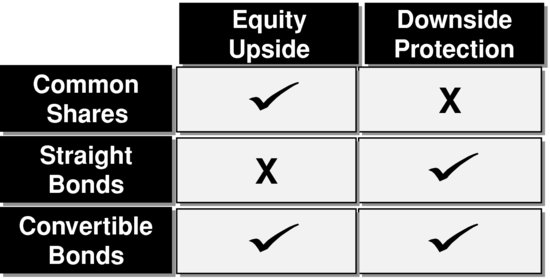

Convertible bonds are instruments which give the holder the right to “convert” a bond into a fixed number of the issuer's common stock (i.e., ordinary shares) at a specified price. Convertible bonds have both common stock and straight bond features. Like common stock, convertible bond holders benefit from an appreciation of the issuer common stock. Like straight bonds (i.e., non-convertible bonds), convertible bonds can have cash redemption at maturity and fixed coupon payments. In this way, convertible bonds reflect a combination of the benefits of stocks and those of bonds (see Figure 3.1).

Figure 3.1 Comparing a convertible bond with common shares and a straight bond.

Commonly, convertible bonds tend to pay ...