28

Limits Policy

La vertu même a besoin de limites. (Montesquieu)

Once the risk free strategy has been described with the delta equivalent techniques, the A/L manager is able to measure the risk position. Associated with this risk position, the ALCO may propose a risk limit policy.

This policy usually has the effect that:

- the gross economic capital will not go beyond a certain amount;

- the interest rate (or liquidity) gap has to be in a specified tunnel;

- the interest rate income sensitivities have to be in a specified tunnel.

28.1 ECONOMIC CAPITAL LIMIT

The economic capital allocation process at the group level is incorporated in the company budgetary process.

This economic capital amount may become a constraint for A/L managers: ALCO may set a limit on the economic value exposure to market conditions.

On the other hand, since the capital allocation process contains a strategic risk allocation, this would impose at least a benchmark for A/L managers and sometimes a minimum amount of economic capital by risk type.

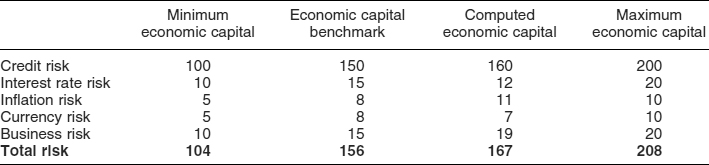

Figure 28.1 Economic capital limit

In the example above, A/L managers have gone beyond the inflation risk economic capital limit: ALCO should decide upon prompt intervention in order to reduce this risk or to review the limit.

28.2 SETTING ECONOMIC CAPITAL LIMITS

Some companies compute their economic capital limits using a model. The idea is to set a confidence interval ...

Get Handbook of Asset and Liability Management: From models to optimal return strategies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.