NETTING

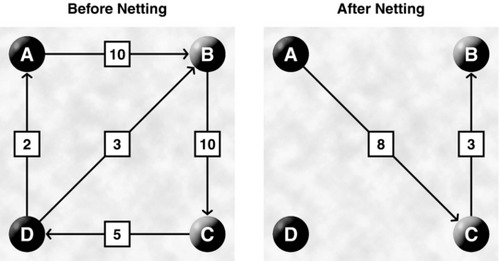

One of the benefits of a CSD is that the centralization of the securities allows members to settle securities trades on a net basis. This eliminates the need to move securities and cash physically from member to member, all such movements being made electronically on a net basis. Netting is a fairly basic concept to understand. Examine the example shown in Figure 3.2.

FIGURE 3.2 The Benefits of Netting

Before netting, A owes B $10; B owes C $10; C owes D $5; D owes A $2; and D owes B $3. If all four parties were to pay each other, then five transactions would need to take place. With the application of netting among the four parties, a different result occurs. Follow the chart. Since B owes C $10, A might as well just pay C directly. Since C owes D $5—but D owes B $3, then C might as well pay B directly and eliminate the needless paperwork. D also owes A $2, which can be deducted from the amount A owes C. Netted down, C pays B $3 and A pays C $8. Instead of five transactions and people running around delivering paper to each other, just two movements are needed. The operational advantage is obvious. This is why advanced securities markets have implemented netting as an efficient means of improving clearing and settlement of securities.

Get Global Securities Markets: Navigating the World's Exchanges and OTC Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.