Attracting the Right Shareholders

Thomas Faust, CEO of money manager Eaton Vance (NYSE: EV), told me he recognizes that keeping the owners of his company happy is his job and pays off in the long run. He explained:

Investors value dividends as an important factor in owning our stock and we have been told this first hand by large institutional holders of Eaton Vance. You could say we benefit indirectly to the extent our stock has a higher valuation because of our long record of dividend increases.

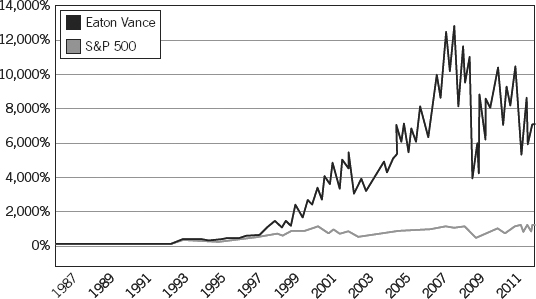

Eaton Vance has grown its dividend every year since 1980, including a 50% increase in 2003, when the dividend tax rate dropped to 15%. That had to make shareholders very happy. (See Figure 4.1.)

Clearly it did. Over the past 25 years, when dividends were reinvested, Eaton Vance’s stock outperformed the S&P 500 by over 5,800%!

As Freyman and Faust appreciate, a dividend that is consistently climbing keeps existing shareholders happy and attracts new ones.

Stocks that have a lot of momentum, whose price is rising rapidly, also attract new shareholders, but are they the right shareholders?

Ultimately, management wants long-term investors as owners of the company. These investors will typically be those who understand the big picture and won’t get bent out of shape if the company’s earnings fail to meet expectations ...

Get Get Rich with Dividends: A Proven System for Earning Double-Digit Returns now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.