Chapter 1. What Makes a Startup Fundable?

So you want to raise money for your startup?

Before you decide if you should raise money, it is important to understand that not every company is fundable.

Fundable, for our purposes, means that your company is attractive to investors that provide growth capital to high-risk, high-growth-potential, early-stage ventures. This type of capital is generally referred to as venture capital, and can be provided by both professional investors (venture capitalists) and private individuals (angel investors).

Venture capital can be provided in exchange for equity (an ownership share in the company) or in exchange for debt. Not every company is attractive as a venture capital investment. Less than 25% of all startup funding is done through venture capital, either in the form of friends and family funding (24%) or through professional venture capital firms (1%). Companies that don’t raise capital self-fund, or use alternate forms of capital covered in the next chapter.

How Investors Make Money

Your investors, and you, will make money when your company reaches a successful liquidity event. A liquidity event is something that converts an investor’s equity in your company into cash. The most common liquidity event is an acquisition, where a company is acquired by another company or private equity firm. Investors can also see liquidity through IPOs (initial public offerings). While an IPO is not technically a liquidity event (it is actually another investment event), it can provide liquidity to shareholders. After a holding or lock-up period specified by the SEC or other regulatory body of 90 to 180 days, existing investors may choose to sell some or all of their holdings. (A liquidity event is not to be confused with the liquidation of a company. In a liquidation event the company’s business is discontinued and assets are sold to pay off the company’s debts and then pay off shareholders with any remaining capital.)

A successful exit or liquidity event for an investor is one in which the value of their shares in your company increases substantially from the time they invested in your company to the time they convert to cash. Not every company will reach a large liquidity event. In fact, 90% of all startups will not only fail to reach a liquidity event, but will go out of business entirely.

Businesses that attract venture capital must have the potential to provide returns much higher than the stock market. Why? Because investing in a startup has much higher risk than investing in the stock market. Your company doesn’t just need to have the potential to generate a slightly higher return than the single-digit average returns on the stock market. It needs to have the potential to provide investors a return so substantial that it can make up for any losses in their portfolios. A rule of thumb is that early-stage venture capital investors are seeking from 3 to 10 times return on investment. Later-stage investors, investing later in a company’s lifecycle and taking on less risk, target lower returns.

A recent study from the Kauffman Foundation, the largest American foundation to focus on entrepreneurship, reported on average returns from a diversified portfolio of 10 or more companies. The report found that on average, half of the companies in an investor’s portfolio will fail (returning nothing or less than the capital invested). Another 3 or 4 will provide a modest return on investment of 1 to 5 times the principal invested—known as a cash-on-cash return—and 1 or hopefully 2 of the 10 companies will return 10 to 30 times on the initial investment over a 5- to 8-year period.

By seeking high returns on the winners in its portfolio, an investor hopes to make up for its losses, targeting a 3x return on investment overall. Companies capable of contributing to these types of returns must be able to rapidly scale into very large businesses, and they need to be addressing a very large market. When you take venture capital into your company, it is your responsibility to provide the highest return possible for your investors. If your intention as an entrepreneur is not to build a massive, fast-growth company, your interests will not be aligned with those of early-stage investors.

The Unicorn

Before we dive into what investors are looking for in fundable companies, let’s set the stage by talking about the most coveted investment outcome—the unicorn. A unicorn is a company that has reached a $1 billion or higher valuation either in the public market or during a private investment round. The term was coined by Aileen Lee, founder of Cowboy Ventures.

The most talked about, and highest valued, unicorn today is Uber. Uber is a mobile app that allows users to request a taxi or an Uber driver who uses their own car to pick the user up. Uber has a valuation of $62.5 billion based on its December 2015 fundraising round, led by venture capital firms like Lowercase Capital, Benchmark Capital, and Google Ventures.

Investors dream of being an early investor in the next unicorn. For some investors it is for prestige, while for others (especially venture capital funds larger than $150 million), it’s not a matter of preference but of necessity. In order to provide an adequate return to their investors, larger funds usually need a share in at least one company of a $1 billion-plus valuation. This means that larger investment funds will not invest in a company if they don’t believe it has the potential to become a unicorn, or if they believe the founder doesn’t have the ambition to build a billion-dollar business.

If your market is not large enough to support a unicorn, or your business model will never scale to create a billion-dollar company, you can still be fundable—but you won’t be able to raise your funding from a larger venture capital fund (more than $150 million in capital).

There are many great businesses that will never become unicorns, and many entrepreneurs who do not aspire to build unicorns. Very early-stage investors can still make significant profits by investing in companies that never become unicorns.

Dave McClure, founding partner at 500 Startups, has coined terms for successful companies that haven’t joined what has been called “the unicorn club.” Dave refers to companies that have a valuation of more than $100 million as “centaurs” and startups that have a valuation of more than $10 million as “ponies.”

Early investors can make a lot of money off of centaurs and ponies, and even off of companies with valuations lower than $10 million.

Investor Expectations as You Grow

While the ability to provide an adequate return is one way to broadly define what makes a company fundable, investors’ expectations of your company will vary depending on the stage it’s in. How investors evaluate your company at the early stage, when you’re raising your first round, will be different from how you are evaluated at later stages.

A company’s first round is commonly referred to as its seed round. This is the earliest, and often the smallest, round a company will raise. Between 2010 and 2014, the average seed round in the US was generally between $0.36 million and $1.5 million. The size of your seed round will be determined by how much money you need to reach your next milestone. This amount varies depending on your product, the barriers to entry in your market, and your geography.

Following a seed round is a Series A. The average Series A deal in the US is between $2 million and $7 million. Series A financing goes to companies that have been able to prove out a reliable sales model. Money raised in a Series A is generally used to prove that the company’s customer acquisition strategies can perform at scale.

After Series A financing, companies can continue to raise capital throughout their lifetimes. Each round typically receives a new letter: Series B, Series C, Series D, and so on. Capital raised in later-stage rounds is invested in further growth. At this point the business, while still risky, is much lower risk than a seed-stage company, with a comparably lower return profile.

Because companies at different stages are evaluated differently, what round a company says it is raising sets the tone of the conversation with investors.

Founders will sometimes characterize a funding round as being earlier than it actually is because they believe this will lower the investor’s expectations of their product, traction, and growth. For example, a founder will say the company is raising a seed round when it is really an A round. This may lower an investor’s expectations, as an earlier funding round suggests that the company has raised less money and has been in business for a shorter period of time.

That said, sometimes founders get a bit carried away, raising multiple seed rounds so that they don’t have to say they are raising a Series A. Likewise, companies raising a B round might say they are raising an A, also to lower investor expectations. The best investors aren’t fooled; they can look at the company and the amount of time and capital that have gone into it and determine what round it is actually raising—regardless of what the founders might call it.

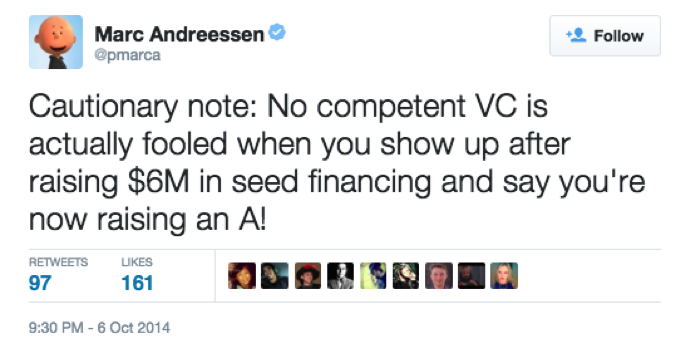

Figure 1-1 shows a tweet by Marc Andreessen on this topic.

Figure 1-1. The best investors can tell what round a company is actually raising

Tier 1 Venture Funds

The highest-caliber venture funds are referred to as Tier 1 venture funds. These funds tend to be larger and participate mostly in Series A+ rounds. There is no set ranking of VCs, and tiers are more a matter of opinion, but funds commonly referred to in the industry as Tier 1 include Andreessen Horowitz, Sequoia Capital, Accel Partners, and Benchmark Capital. The following are some of the factors that play into a firm being considered Tier 1:

- Brand value

- Whether a VC firm adds legitimacy to the companies it invests in. Will it raise the profile of those companies? Does the firm have a strong track record of success?

- Returns

- The amount a fund has historically made back on its investments and the consistency with which it delivers good returns to its investors.

- Network

- How connected the firm is and what introductions it will be able to make to open doors for its companies.

- Other added value

- Other ways that venture firms help their companies with things like sales, recruiting, or finding exit opportunities.

If you are able to raise from Tier 1s, meaning you have the connections and the business fundamentals to attract their interest, they are who you want to raise from. That said, as appealing as Tier 1s may be, if you don’t have the right connections and aren’t a hot deal, you may waste time courting Tier 1s and should look at putting more effort into conversations with lower-tier investors.

Note

Sand Hill Road is a street in Menlo Park, California, that has the largest concentration of VCs in the world. Almost every prominent company in Silicon Valley has received funding from at least one investor on Sand Hill Road. Kleiner Perkins Caufield & Byers was the first VC to set up shop on Sand Hill Road, in 1972. Sand Hill Road also boasts the most expensive office space in the United States, at $141 per square foot.

Conclusion

This chapter has introduced what it means to be venture capital fundable. Understanding how investors make money, why some startups fail, and the holy grail of venture capital—the unicorn—will help you communicate with investors on their terms.

The remainder of the book will focus in detail on investor expectations for seed-stage companies in particular. We will take a deep dive into how investors discover, evaluate, and invest in these opportunities, and how you can position your company to secure their investment.

Even if your business is not a perfect match for venture funding today, based on what we’ve discussed in this chapter and what we’ll cover throughout the rest of the book, don’t worry: you’ll be able to continue to use the knowledge you’ll gain in this book to become a fundable opportunity.

You will also have the opportunity to reach your goals through other forms of capital that may be better suited to your business. In the next chapter we’ll dive into each of these alternatives as we weigh the pros and cons of venture capital.

Get Funded now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.